Irs 2022 Fsa Limits

Notice 2021-15 PDF issued in February 2021 states that if an employer adopted a carryover or extended period for incurring claims the annual limits for dependent care assistance program amounts apply to amounts contributed not to amounts reimbursed or available for reimbursement in a particular plan or calendar year. A Health or Dependent Care Flexible Spending Account FSA allows participating employees to reduce their earnings on a pre-tax basis to pay for certain qualified expenses.

Irs Clarifies Aspects Of Recent Fsa And Cafeteria Plan Accommodations Lockton

These unofficial 2022 limits are determined using the Internal Revenue.

Irs 2022 fsa limits. 2021-25 also includes the excepted benefit Health Reimbursement Arrangement EBHRA limit for 2022. 3 rows Health savings account HSA contribution limits for 2022 are going up 50 for self-only. 280 for each return with respect to which a failure occurs.

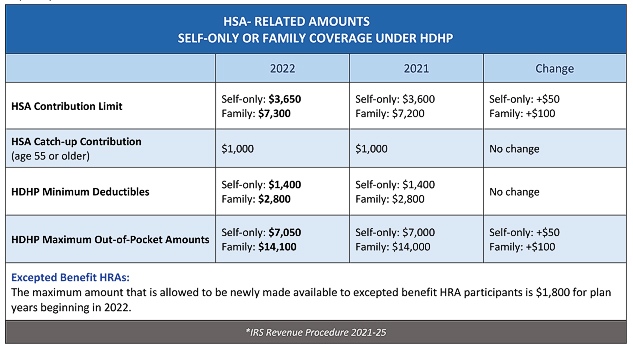

Flexible Spending Limited Flexible Spending 275000 max election per year. The Internal Revenue Service IRS has released Revenue Procedure 2021-25 that provides the health savings accounts HSA limits and excepted benefit health reimbursement arrangements EBHRA for 2022. Therefore participants in dependent care assistance programs may continue to contribute the maximum amount to their plans for 2021 and 2022.

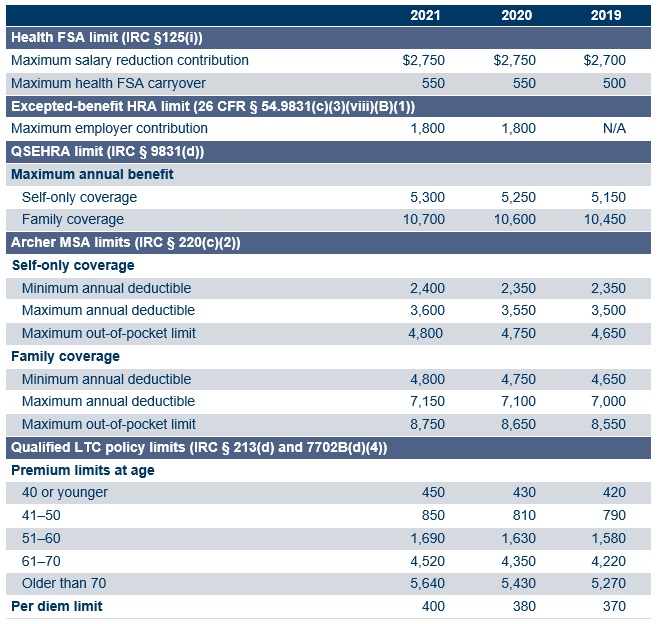

The Health Care standard or limited FSA annual maximum plan contribution limit is projected to increase from 2750 to 2850 in 2022. Dependent Care Flexible Spending Account. Special Rules for FSA Rollover for 2022 Due to the pandemic all unused FSA balances will automatically rollover from 2021 to 2022.

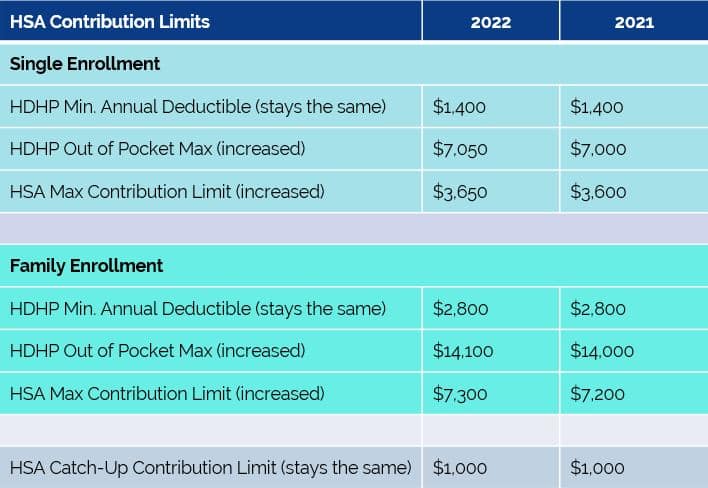

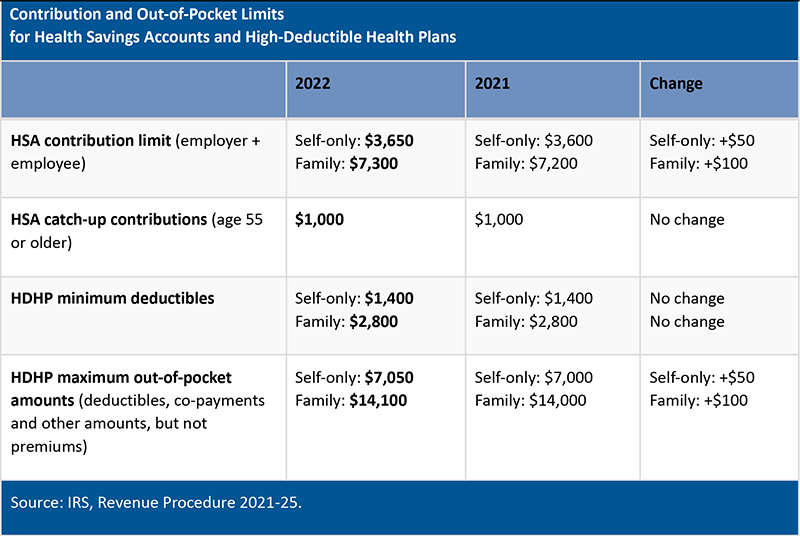

Note that there are other types of FSAs such as dependent care FSAs with different limits. There is no limit on the rollover amount for either Healthcare or Dependent care. On Monday May 10 the Internal Revenue Service IRS published the 2022 HSA contribution limits out-of-pocket limits and high deductible health plan HDHP minimum deductiblesRev.

The same limit applies for general-purpose and limited-purpose health FSAs. The Healthcare FSA contribution limit will go up by 100 from 2750 per person in 2021 to 2850 per person in 2022. For calendar year.

The amount that can be carried over to the following plan year is set to 20 of the annual contribution limit. Annual penalty limit for non-willful failures. 7 rows 2022.

The IRS released Rev. A health FSA may extend the grace period for using unused benefits for a plan year ending in 2020 or 2021 to 12 months after the end of the plan year. A health FSA may allow participants to carry over unused benefits from a plan year ending in 2020 to a plan year ending in 2021 and from a plan year ending in 2021 to a plan year ending in 2022.

The FSA carryover limit for 2020-2021 was increased to 550 earlier this year in a Notice from the IRS. For calendar year 2022 the maximum HSA contribution is 365000 for a person enrolled as single and 730000 for a person enrolled as family. 1000 2022 Statutory Deductible Limit Individual.

Dependent Care- 500000 max election per household per year. For calendar year 2022 the annual limitation on deductions for an individual with self-only coverage under a high deductible health plan is 3650. Health FSA Carryover Maximum.

If the new higher exclusion limit under ARPA is not extended by future legislation to apply to years after 2021 then the prior 5000 limit will apply again for 2022 2023 and future years. This means that for the Healthcare account you may carry over 2750 into 2022. Therefore absent additional congressional action the dependent care FSA limit will revert to.

Annual Contribution Limit. Failure to file an information return or provide a payee statement. The IRS has announced 2022 pre-tax limits for the following programs.

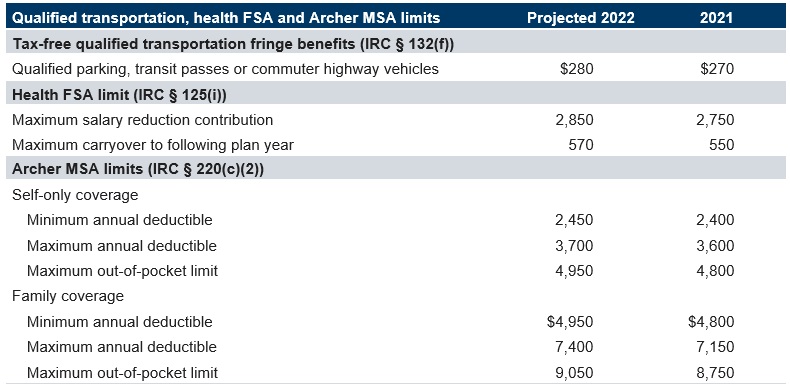

Pre- tax Transit Parking Plans 27000 each per month. Mercer projects the 2022 limits for qualified transportation parking and transit benefits health flexible spending arrangements FSAs and Archer medical savings accounts MSAs will increase. Lower limit for entities with gross receipts not exceeding 5M.

2022 Flexible Savings Account FSA Contribution Limits Healthcare FSA contribution limits will increase from 2750 in 2021 to 2850 in 2022. IRS Limits on Health Savings Accounts HSAs Non-HDHP Out-of-Pocket Limits. The Health Care standard or limited FSA rollover maximum limit is projected to increase from 550 to 570 in 2022.

2022 transportation health FSA and Archer MSA limits projected. Employee Benefits Annual Limits. Employer contributions are not subject to the limit but are subject to different restrictions under healthcare reform rules.

In Revenue Procedure 2021-25 the IRS announced the calendar year 2022 inflation-adjusted dollar limits for health savings accounts HSAs and high-deductible health plans HDHPs effective for calendar year 2022Revenue Procedure 2021-25 also includes the maximum annual amount that may be made newly available for excepted benefit health reimbursement arrangements EB. 280 for each return with respect to which a failure occurs. HSA FSA Transportation and Parking limits for 2022.

The 2022 amounts for HSAs as compared to 2021 are as follows. The annual contribution limit of 2750 for health FSAs applies specifically to employee contributions. 2750 is the limit per FSA account but if you and your spouse both elect FSAs through your employers your total household FSA budget for 2021 could be 5500.

2021-25 on May 10 2021 containing the 2022 high deductible health plan HDHP and health savings account HSA annual limits. Department of Health Human Services also recently released its Notice of Benefit and Payment Parameters for 2022 which include the 2022 annual limits for non-grandfathered medical plans subject to the Affordable Care Act.

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

Irs Announces 2022 Limits For Hsas And High Deductible Health Plans

Hsa Dcap Changes For 2022 Blog Medcom Benefits

Fsa Rules 3 Tips For Easily Complying With The Irs Connectyourcare

Hsa And Hdhp Limits Increase For 2022

Irs Releases 2022 Health Savings Account Hsa Contribution Limits

Irs Releases Hsa Contribution Limits For 2022 Primepay

Irs Releases 2022 Hsa Contribution Amounts And Excepted Benefit Hra Maximum Benefits Hrpro

Irs Announces 2022 Limits For Hsas And High Deductible Health Plans

Irs Releases 2022 Hsa Contribution Limits And Hdhp Deductible And Out Of Pocket Limits Csnw Benefits

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

Sterling Administration 2022 Hsa And Hdhp Limits Claremont Insurance Services

Irs Announces 2022 Health Savings Account Limits As Hsa Assets Soar

2021 Fsa Commuter Benefits Contribution Limits Released Wex Inc

2021 2022 401k 403b 457 Ira Fsa Hsa Contribution Limits

What The New Hsa Limits For 2022 Means For You The Difference Card